2022 tax brackets

Download the free 2022 tax bracket pdf. These are the 2021 brackets.

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

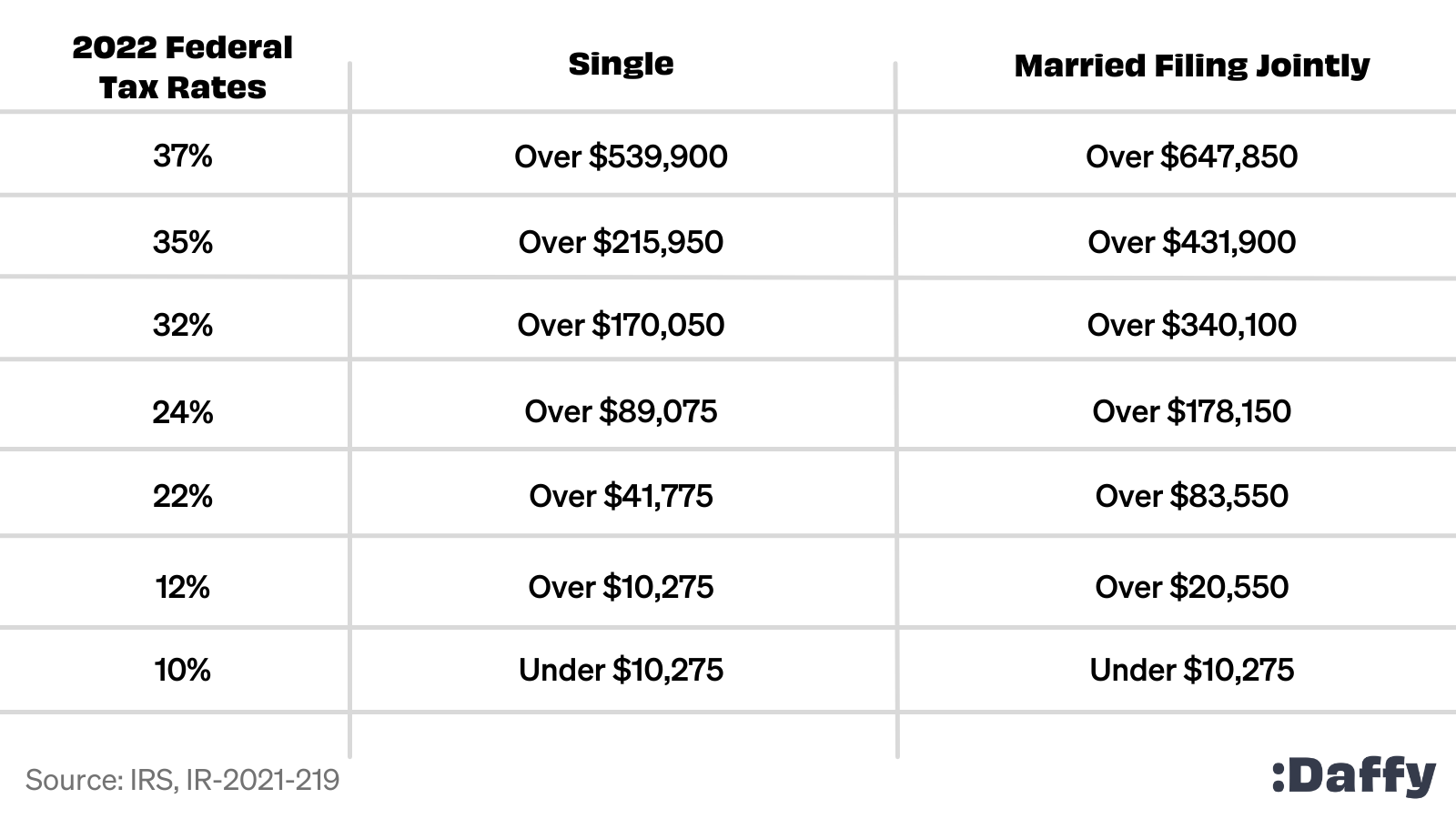

10 12 22 24 32 35 and 37.

. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023. The federal income tax rates for 2022 did not change from 2021. These are the rates for taxes due.

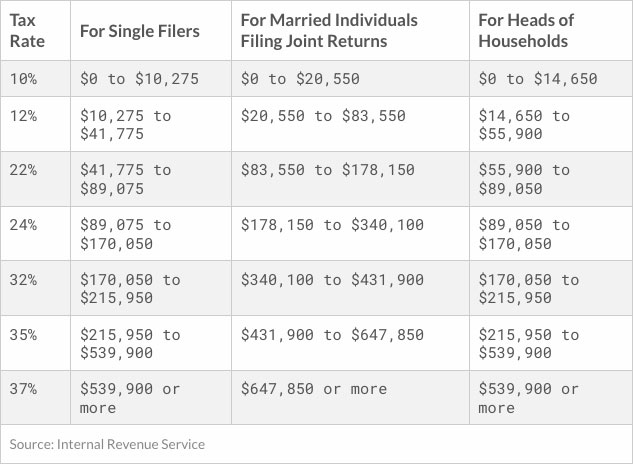

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. 10 12 22 24 32 35 and 37. The 2022 tax brackets affect the taxes that will be filed in 2023.

The seven tax rates remain unchanged while the income limits have been adjusted for inflation. 12 hours agoThe IRS has released higher federal tax brackets for 2023 to adjust for inflation. Your bracket depends on your taxable income and filing status.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. The federal income tax rates remain unchanged for the 2021 and 2022 tax years. Whether you are single a head of household married etc.

10 12 22 24 32 35 and 37 depending on the tax bracket. The income brackets though are adjusted slightly for inflation. There are seven federal income tax rates in 2022.

7 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. The standard deduction is increasing to 27700 for married couples filing together and 13850 for single taxpayers. 2022 tax brackets are here.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. There are seven federal tax brackets for the 2021 tax year. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends at 89075.

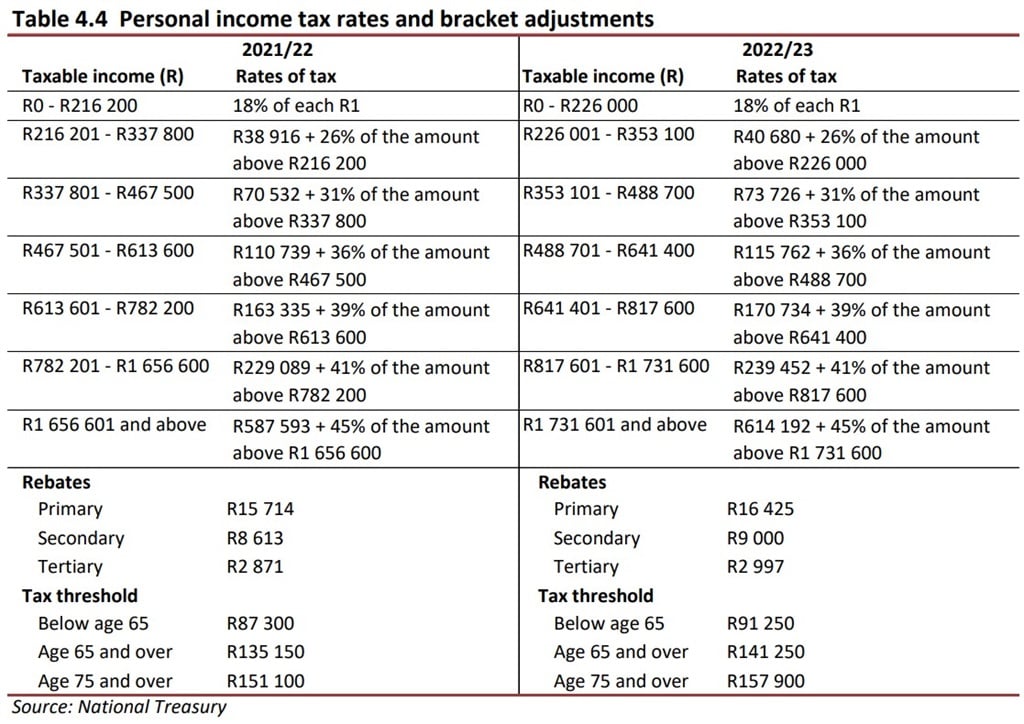

How Much You Will Be Taxed In South Africa In 2022 Based On What You Earn

Germany Corporate Tax Rate 2022 Take Profit Org

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Top 15 Federal Income Tax Brackets Tax Rates In 2022 Chungkhoanaz

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

New 2022 Tax Brackets Ckh Group

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

The Complete 2022 Charitable Tax Deductions Guide

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

2022 2023 Tax Brackets Rates For Each Income Level

Uk Income Tax Rates And Bands 2022 23 Freeagent

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Tax Bracket Calculator What S My Federal Tax Rate 2022

2022 Corporate Tax Rates In Europe Tax Foundation

Budget 2022 Tax Relief These Are All The Big Changes Fin24